Considering Landscape Improvements for Your Home? Get Inspired

April 2, 2020

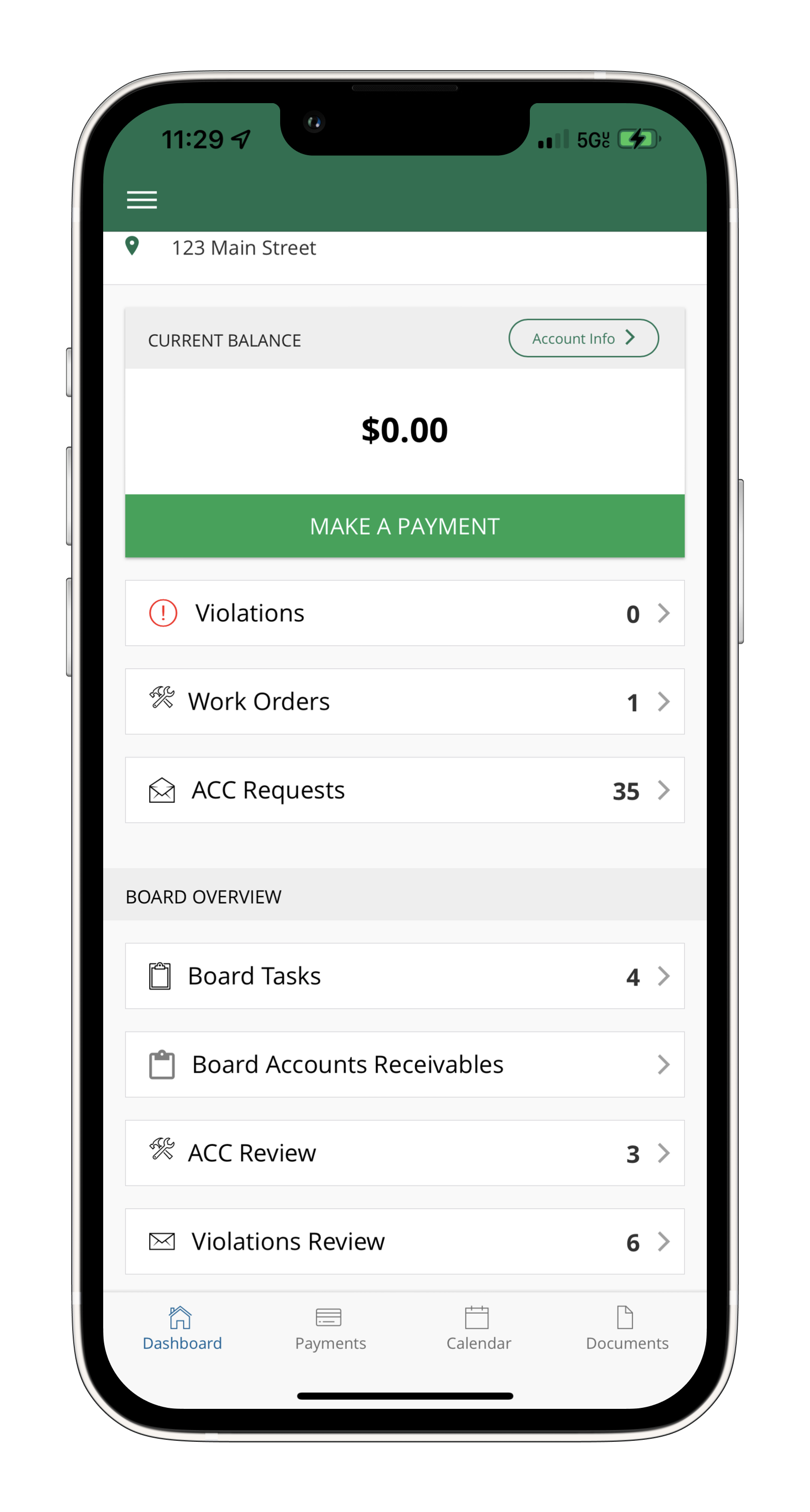

Try Streamlining ACC Processing with an Electronic Portal

May 5, 2020“It takes a knowledgeable agent to navigate an often complex and always fluid marketplace.”

Isn’t open competition the preferred way get the best insurance coverage at the best price in the market? Yes, but the commercial insurance market isn’t always straightforward. It takes a knowledgeable agent to navigate an often complex and always fluid marketplace.

Independent agents routinely request bids from the same limited number of insurance companies/underwriters for HOA policy coverage. Carriers will only offer a quote to the agent of record. This complicates the competitive bidding process.

Daniel Holt, Account Executive of Scarbrough, Medlin and Associates Inc. in Plano, TX explains, “When it comes to being independent, we have access to multiple markets. When (a board) wants three bids, we are basically getting three bids for them. They don’t have to have three separate agents do it. Because you can have three agents going to the same markets and then in turn you are going to have two agents not being able to get quotes.”

Are the large national carriers with high-profile marketing campaigns and local agent offices an option for HOA insurance coverage?

According to Rod Medlin, Vice President and Chief Operating Officer of Scarbrough, Medlin and Associates, Inc. they can be, but with some potential limitations. “They’ll be apples to apples pretty much on the property and the G/L (general liability). Where they really fall short is in the D&O (directors’ and officers’ liability).” Shopping the best D&O policy is critical to protect board or committee member liability when serving their association. Limiting available coverage options to one carrier can be risky in and of itself. Large national carrier agents differ from independent agencies as Holt explains, “Those are captive agents; those agents can only work with that carrier.”

As with any vendor serving your association, a board should expect an insurance agent to provide the best possible solution and value for your community. A good agent will help you assess potential risks and gaps in coverage. Ideally, associations should build a strong relationship with a trusted insurance agent and avoid the pitfalls of multi-brokering. Your association’s business should be earned every policy year. Experienced agents know this when being compared to other agencies.

Since 1983 CMA Management has worked with knowledgeable insurance agents to service our clients’ coverage needs, no matter how complex.

Rob Koop

AMS®, CMCA®

Executive Vice President of Portfolio Operations

If you found this article helpful, you may also find other topics relevant to your HOA on this blog at Community. Well-Served.