Leadership Advisor: Summer 2018

June 20, 2018

The Texas Supreme Court’s Opinion on Short-Term Rentals

July 12, 2018

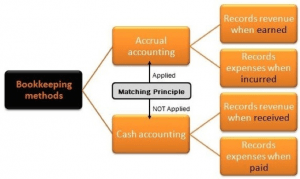

The accounting method your HOA uses has long-term consequences on how your financial transactions and your business will be managed for years to come. CMA highly recommends the accrual method as the best practice for HOAs.

The following comparison of two commonly used financial reporting methods illustrates the benefits of accrual accounting.

Cash Accounting Method

If you have ever run a small business, you are familiar with this basic system of counting income when checks are received and expenses when debts are paid. While it is simple to work with, it fails to meet the demands of complex organizations, including HOAs. This system does not allow the organization to track accounts receivable or accounts payable. It also doesn’t account for unpaid bills that are coming up, so your ending balance may be far less than you anticipate. The end result is an inaccurate picture of your account.

Accrual Accounting Method

Accrual accounting is CMA’s standard for HOA financial reporting. The method is in accordance with Generally Accepted Accounting Procedures (GAAP). Whereas cash accounting only records revenue when received and expenses when paid, accrual accounting records revenue when earned and expenses when incurred.

Accrual Accounting refers to recording revenues and expenses when they are incurred, regardless of when cash is received or paid. The term “accrual” refers to any individual entry recording revenue or expense in the absence of a cash transaction.

During the time between the delivery of a service and when the bill is paid, a cash accounting system would fail to show the expense, but the accrual method provides an accurate view of the present financial condition of the HOA. This level of accurate allocation of expenses and revenues enables you to keep track of your profitability at all times, enabling you to budget accurately for the months and years ahead. Financial managers also prefer this system for its ability to deliver effective reports that facilitate informed decision making by the board.

Why the Method Matters

- Most associations assess their homeowners on a quarterly, semi-annual, and annual basis. Because the reporting we do to our boards is on a monthly basis, the accounting team must ensure that each month is assigned its share of the revenues.

- The board sees a true picture of money available monthly and makes spending decisions based on this knowledge. For example, if the board spends money that should have been set aside for insurance, the month the annual insurance payment comes due, the association may come up short.

If you are operating on the cash accounting method and realize your organization has outgrown its utility, it can be a daunting process to make a change. Trust a management company with years of experience to help you transition and ensure your financial stability throughout the process.

Bill Partridge

Chief Financial Officer, CPA