Should Your Association Hire a Consultant to Oversee a Project?

July 16, 2019

What’s Missing from Your Association’s Budget?

August 26, 2019

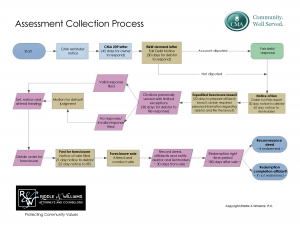

The Process for Expedited, Non-Judicial Foreclosure for Single Family POAs

Uncollected assessments and other HOA fees are the source of concerns and questions from many board members. Federal and Texas statutes detail the conditions and procedures for the collection of delinquent debts by single family POAs in Texas.

When an Owner becomes delinquent, the Association can communicate with the Owner on its own or through its management company regarding the debt and the Owner’s non-payment. This can be done before an attorney is engaged to assist in collecting the debt.

In the event the Association desires to engage a law firm to assist with collecting the debt, the Association should comply with Section 209.0064 of the Texas Property Code by sending a letter to the Owner that informs the Owner of the debt and describes the options the Owner has to resolve the debt.

In the event the Association desires to engage a law firm to assist with collecting the debt, the Association should comply with Section 209.0064 of the Texas Property Code by sending a letter to the Owner that informs the Owner of the debt and describes the options the Owner has to resolve the debt.

Compliance with Section 209.0064 is absolutely necessary in order for the Association to hold the Owner liable for the attorney fees the Association incurs in attempting to collect the debt. Referred to as a 209 letter, this letter must notify the owner of certain information and rights, including each specific delinquent amount or charge, the total delinquent balance, providing the Owner a 45-day cure date, providing the Owner with an opportunity to enter into a payment plan, and must be mailed via Certified Mail. Once the 45 days has expired, the account is ready to turn over for attorney collections and the Association will be able to hold the owner liable for its attorney’s fees.

A general description of the steps an attorney may take in collecting unpaid assessments, including the process for an expedited foreclosure lawsuit, can be downloaded here.

Grant Neidenfeuhr

Grant Neidenfeuhr

Shareholder, Riddle & Williams, P.C.